GST Number Search Online – Verify GSTIN

Click here to find out

HSN / SAC Codes

for goods and services.

GST search tool helps you check the validity of a GST Identification

Number (GSTIN) on the internet. Clear’s GST search also allows any

person to verify the GSTIN authenticity for easily spotting fake

GSTIN. Read on to know more about the terms and uses of the GST search

tool.

What is GSTIN?

GSTIN is the GST identification number or GST number. A GSTIN

is a 15-digit PAN-based unique identification number allotted to every

registered person under GST.

As a GST-registered

dealer, you might want to do a GST verification before entering it into

your GST Returns. So, you can use the GST number check tool to do GST number (GSTIN)

verification.

There can be multiple GSTINs for a single person with a PAN, being an

assessee under the Income Tax Act. GSTIN is obtained for every State or

Union Territory from which such person operates.

It becomes compulsory to obtain GSTIN when the person crosses the

threshold limit for GST registration by registering himself under

GST.

Unlike the previous indirect tax regime, where multiple registration

numbers were present for different laws like Excise, Service Tax and

VAT, it is a single registration number under GST- GSTIN.

Why is it necessary to verify GSTIN or do GST Search?

GSTIN or GST number is public information. GST search by name is an

important task that every business dealing with GST-registered taxpayers

must carry out to ensure the authenticity of the vendor and the GSTIN or

GST number being used in the invoice.

Technology has enabled you to verify GSTIN with a click of a button

from anywhere and anytime. Search GST number before you proceed with a

deal.

You can partly verify the GSTIN or GST number on the first look by

checking if the vendor’s PAN number matches with the digits between 3

and 10 in the GSTIN.

Use the Clear’s GSTIN verification tool and GST Search to verify GSTIN

or verify the GST number in a jiffy!

Below is the format of GSTIN depicted in pictorial form.

GSTIN structure comprises

-

First 2 numbers → State code of the registered person

-

Next 10 characters → PAN of the registered person

-

Next number→ Entity number of the same PAN

-

Next character → Alphabet Z by default

-

Last number → Check code which may be alpha or digit, used for

detection of errors

What is the Clear GST Number Search Tool?

The Clear GST Search Tool and GSTIN Validator enable businesses to verify

any GSTIN with a single-click GSTIN search. This feature can be used by

anyone free of cost, provided they have the requisite GSTIN on hand.

You must validate the GST number to avoid doing business with any fake

GSTINs in the market. Our GST number search tool comes in handy during

such times so that you and your team can carry on business without any

disruption or delays or vendor follow-up.

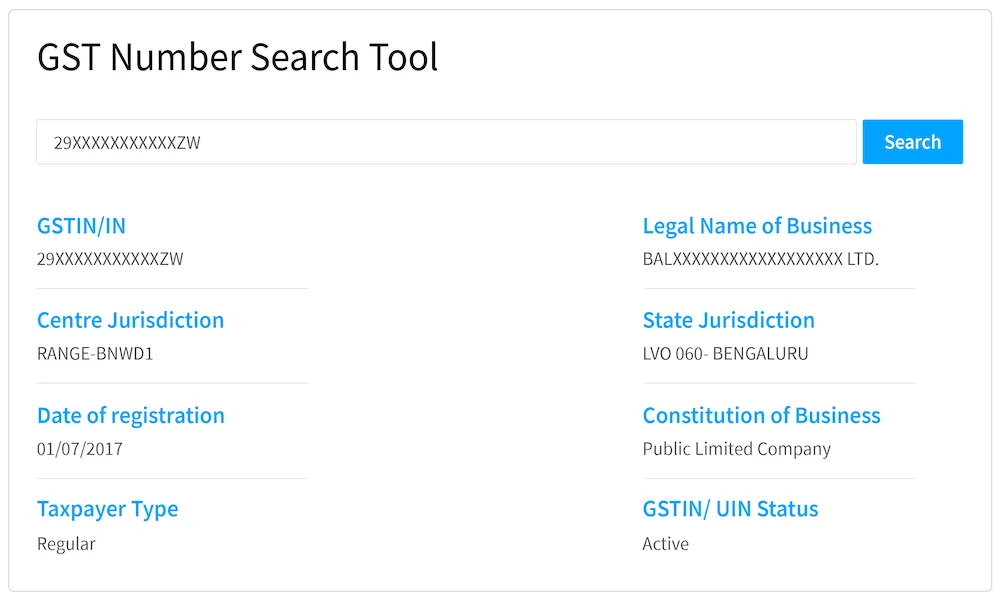

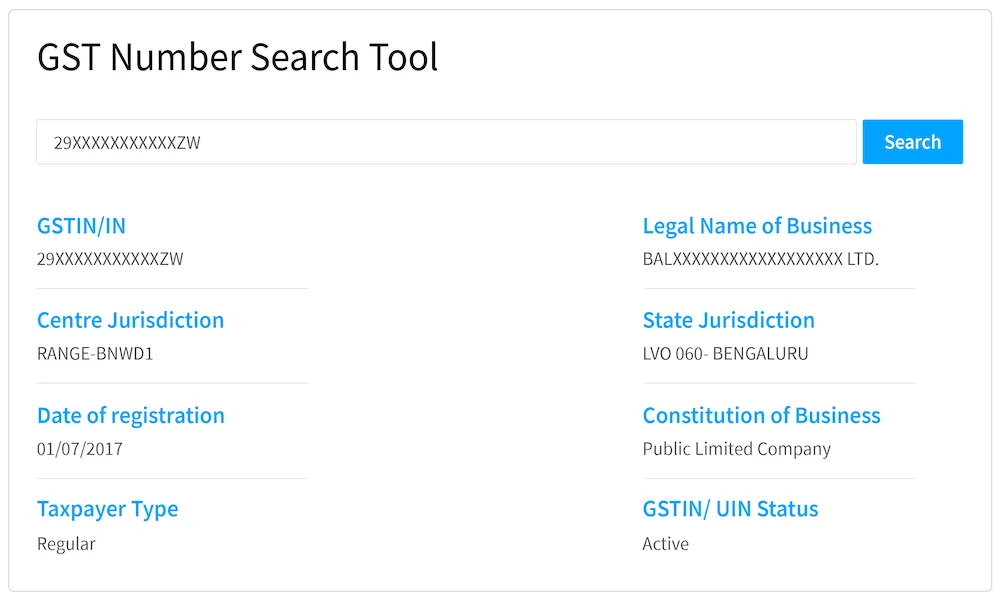

How to use the Clear GST Search Tool and GSTIN Validator?

Verify GST Number online instantly. All you have to do is-

-

Enter a valid GSTIN in the search box below

-

Click on the “Search” button

If the GSTIN is correct, the following details can be verified-

-

The legal name of the business

-

State

-

Date of registration

-

Constitution of business – company, sole-proprietor or

partnership

-

Taxpayer type – regular taxpayer or composition dealer

-

GSTIN status / UIN status

GST Return Filing & Billing simplified with Clear

GST Software

Advantages of online GST search & verification tool or GSTIN

Validator

The benefits of GST number verification using the online GST Search tool

are:

-

To check the authenticity of any GSTIN

-

A GSTIN on a hand-written invoice can be verified easily, if

unclear

-

You can prevent yourself from associating with vendors using fake

GSTINs

-

Avoid a GSTIN fraud

-

Help vendors correct any potential error in reporting GSTIN

Frequently Asked Questions

When will a GSTIN be allocated?

Once the GST registration application is processed successfully, the

GST portal will allocate 15 digit GSTIN to the applicant.

Is it mandatory to mention GSTIN on the invoices?

Yes, it is mandatory to mention GSTIN on all the invoices raised by a

taxpayer. Also, the GST-registered person should display the GST

registration certificate at all places of business.

How to get GST Identification Number?

To get GSTIN, one has to submit the Form GST REG-01 along with the

required documents using the GST portal. After an officer performs a

verification, GSTIN will be allocated to the applicant.

What are the uses of GSTIN?

GSTIN is one of the prerequisites for starting a business. As per the

GST law, GSTIN has to be displayed at all places of businesses of a

registered individual. Also, it has to be quoted during the process of

raising invoices, while generating e-way bills, during GST return

filing, and during the submission of information to the tax

department.

Can I hold multiple GSTINs or GST numbers?

If a business operates from more than one state, the taxpayer can hold

separate GST registration for each state. For instance, If a textile

company sells in Telangana and Delhi, it has to apply for separate GST

registration in Telangana and Delhi respectively.

GST Invoicing made easy with

ClearTax GST Offline Utility. Click here to get the ‘Offline GST Template’ and ‘How to Use’

Guide for FREE.

Calculate monthly Pension & Tax Benefits through Cleartax

NPS Calculator

FinTech Glossary

– Here is a way out for you to understand the jargons used in

FinTech

IFSC Code

Search India – Search & Find IFSC & MICR for all Bank

Branches

Section 206AB

– Finance Act 2021 introduced new sections

206AB

and 206CCA levying a double TDS rate for the non-filers of ITR of

two previous years.

Income Tax

– Learn everything you need to know about income tax

Mutual Funds

– Invest in top mutual funds online at 0% commission

File ITR

in Just 3 minutes using ClearTax

Never miss a

deadline

Stay ahead of due dates with

GST calendar

- Accurate and up-to-date

- Curated by our 60+

in-house tax experts

- Avoid incurring any

interest or late fee

Download now