Advance Tax Payment: Due Dates, Calculator, Applicability, Procedure, Installment Details

In advance tax mechanism, tax is paid during the financial year by the taxpayer instead of paying while filing the returns. If the tax on such income exceeds Rs. 10,000 for the financial year, he should pay advance tax.

Advance Tax Due Date

- The due date to pay the 4rd installment of advance tax for Q4 FY 2025-26 (Jan-Mar) is March 15, 2026

- Taxpayers should make sure to pay 100% of the total tax liability for the year by March 15, 2026.

What is Advance Tax?

Advance tax is income tax paid through multiple installments before the end of financial year, instead of a lump sum payment after the end of the financial year. The provisions related to advance tax are covered under section 207 to section 219 of the Income tax act.

The taxpayer calculates the estimated total income at the beginning of the financial year, thereby estimating his tax liability. The advance tax payments have to be made in fixed percentage through four installments as per the due dates provided by the income tax department.

Who Should Pay Advance Tax?

- As per section 208 of the Income tax act, any assessee whose estimated tax liability for the financial year exceeds Rs 10,000, he or she is required to pay advance tax.

- If TDS is already deducted against a person, and still Rs 10,000 tax is payable as per estimation, he /she also needs to pay advance tax.

- This provision applies to all taxpayers, salaried individuals, freelancers, and businesses.

Note: Senior citizens– People aged 60 years or more who do not have income from any business or profession during the financial year are exempt from paying advance tax. However, senior citizens (60 years or more) having business or professional income must pay advance tax.

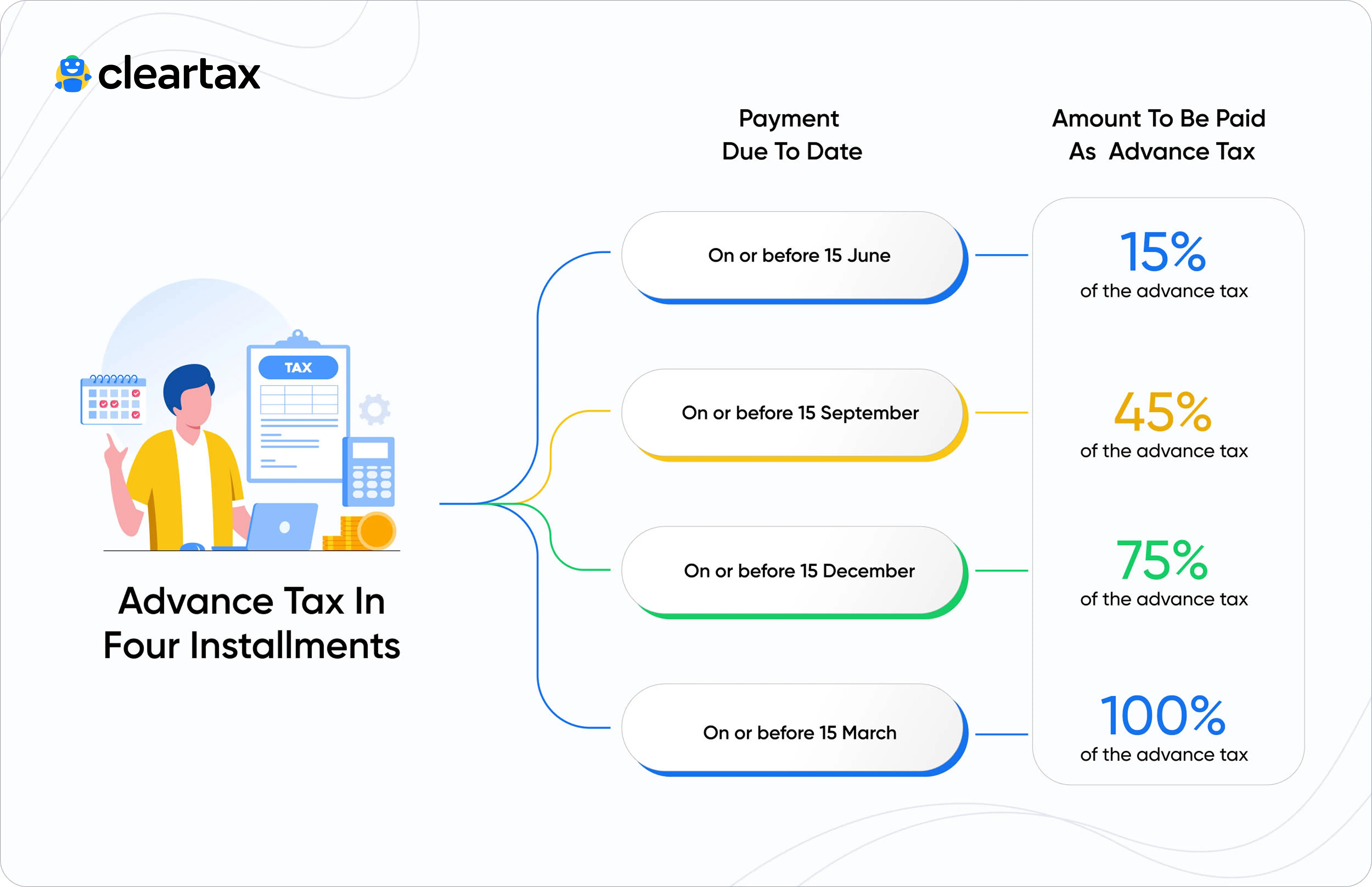

Advance Tax Rates and Due Dates For FY 2025-26

The due date for advance tax payments for FY 2025-26 is given below:

Regular Taxpayers

| Instalment | Due Date | Advance Tax Payment Percentage |

| First Instalment | On or before 15th June 2025 | 15% of tax liability |

| Second Instalment | On or before 15th September 2025 | 45% of tax liability (-) advance tax already paid |

| Third Instalment | On or before 15th December 2025 | 75% of tax liability (-) advance tax already paid |

| Fourth Instalment | On or before 15th March 2026 | 100% of tax liability (-) advance tax already paid |

Note: No interest u/s 234C shall be levied if you have paid advance tax up to 12% in first instalment and up to 36% in second instalment.

Taxpayers Opting Presumptive Taxation

For freelancers, small business owners who have opted for Presumptive Taxation Scheme under sections 44AD & 44ADA – the advance tax due dates are as follows.

| Due Date | Advance Tax Payment Percentage |

| On or before 15th March 2026 | 100% of advance tax* |

*Taxpayers opting for presumptive taxation also have the option to pay all of their tax dues by 31st March. However, any person engaged in business and opted for the presumptive scheme under section 44AE is required to pay advance tax in four instalments on or before the due date as prescribed by the income tax department.

Want a CA to calculate and help pay your advance tax dues? Get in touch with ClearTax!

How to calculate Advance Tax?

Here is a step by step guide to ascertain your advance tax liability and instalment amount.

Step 1: Consider your income earned for preceding financial years.

Step 2: Ascertain how much more or less you will earn as compared to preceding years.

Step 3: Consider all your eligible deductions and exemptions.

Step 4: Make an estimate of your total taxable income.

Step 5: Using our tax calculator, calculate the tax liability under the most beneficial tax regime for you.

If your total tax liability exceeds Rs.10,000 for the financial year, you are required to pay advance tax.The below table will help you understand better.

| Particulars | Amount |

| Gross Total Income | XXX |

| (-) Deductions Under Chapter VI | XXX |

| Net Total Income | XXX |

| Tax Liability | XXX |

| (+) Surcharge | XXX |

| (+) Health & Education Cess | XXX |

| Gross Tax Liability | XXX |

| (-) TDS/TCS | XXX |

| Net Tax Liability | XXX |

Advance Tax liability will be 15%, 45%, 75%, and 100% of Net Tax Liability for the month of June, September, December, and March respectively.

How to Pay Advance Tax Online?

The following step-by-step guide illustrates the procedure to pay advance tax online.

Pay Advance Tax Without Logging In to the Income Tax Portal

Step-1: Visit the e-filing portal of the Income Tax Department of India

Step-2: On the left side of the home page, there is a 'Quick Links' section, click on the 'e-Pay Tax' option. You can also search for 'e-Pay Tax' in the search bar.

Step-3: On this page, enter your PAN and re-enter to confirm it. Then, enter your mobile number and click on ‘Continue’.

Step-4: Now enter the 6-digit OTP received on your mobile number and 'Continue'.

Step-5: Select the first box labelled as ‘Income Tax’ and click on ‘Proceed’

Step-6: Select the ‘Assessment Year’ as 2026-27 and ‘Type of Payment’ as ‘Advance Tax (100)’ and click on 'Continue'.

Step-7: Enter all the tax details.

Step-8: Select the payment method and the bank and press 'Continue'.

Step-9: Preview the challan details and click on ‘Pay Now’. You may also ‘Edit’ these details if required.

Step-10: After completing the payment, you will get an acknowledgement on the next screen. You can see the BSR code and challan serial number on the right side of the challan. Save a copy of this tax receipt for future reference. You will need to enter the BSR code and challan number in your tax return.

Pay Advance Tax by Logging into Income Tax Portal

Step-1: Go to incometax.gov.in, and login to your account with your user ID (PAN) and password.

Step-2: Go to e-file > e-pay tax.

Step-3: On the top right corner, click on “New Payment”.

Step-4: Various types of payments like TDS payment, equalization levy, income tax options are available on the screen. Choose Income Tax - which contains advance tax and self assessment tax. Click ‘Proceed’.

Step-5: Choose Assessment Year 2026-27, and minor head as ‘Advance Tax’ with code 100.

Step-6: Enter the components of tax like taxes, surcharge, cess, interest, etc.

Step-7: Choose the mode of payment and click ‘Pay Now’ on the next page.

Step-8: Read the terms and conditions, agree and then complete the payment through the mode chosen.

Advance Tax Calculator – Calculate Advance Tax Liability

Use this intuitive tool from ClearTax to calculate your advance tax liability:

Advance Tax Calculation - An Illustration

Let's understand the calculation with the help of an example. Ajay is a freelancer earning income from the profession of interior decoration. For the FY 2025-26, Ajay estimates his annual gross receipts at Rs 20,00,000. Ajay estimates his expenses at Rs 12 lakhs. Ajay has deposited Rs 40,000 in PPF account. Ajay has also paid Rs 25,000 towards the LIC premium. Further, Ajay has paid Rs 12,000 towards the medical insurance premiums. Professional receipts of Ajay are subject to TDS. Ajay estimates a TDS of Rs 30,000 on certain professional receipts for the FY 2025-26. Besides professional receipts, Ajay estimates an interest of Rs 10,000 on fixed deposits held by him. Ajay’s advance tax liability would be as below:

| Income Estimation for Advance Tax | Amount (Rs) | Amount (Rs) |

| Income from profession: | ||

| Gross receipts | 20,00,000 | |

| Less: Expenses | 12,00,000 | 8,00,000 |

| Income from other sources: | ||

| Interest from fixed deposit | 10,000 | |

| GROSS TOTAL INCOME | 8,10,000 | |

| Less: Deduction under section 80C | ||

| Contribution to PPF | 40,000 | |

| LIC premium | 25,000 | |

| 65,000 | ||

| Deduction under section 80D | 12,000 | 77,000 |

| TOTAL INCOME | 7,33,000 | |

| TAX PAYABLE | 59,100 | |

| Add: Education cess @ 4% | 2,364 | |

| GROSS TAX LIABILITY | 61,464 | |

| Less: TDS | 30,000 | |

| TAX PAYABLE IN ADVANCE (as it exceeds Rs.10,000) | 31,464 |

The advance tax instalment amounts can be calculated as shown below:

| ADVANCE TAX PAYMENTS | ||

| Due date | Advance tax payable | Amount (Rs) |

| 15th June | 15% of Advance tax | 4,700 |

| 15th September | 45% of Advance tax | 9,400 (14,100-4700) |

| 15th December | 75% of Advance tax | 9,400 (23500-14100) |

| 15th March | 100% of Advance tax | 7900 (31,400-23500) |

Note:

1. The above example of tax liability is calculated under the old tax regime since deductions under section 80C are beneficial to the assessee & the said section is available only in the case of the old tax regime.

2. In the above case, the assessee is not liable to pay any advance if the net tax liability is not more than Rs.10,000, after adjusting with the TDS/TCS.

How to use Challan Correction Feature?

Challan ITNS 280 should be used to pay advance tax online. Follow these steps to make corrections to tax challan:

- Log in to the e-filing ITR portal

- Select “Challan Correction” from the services tab

- Click on "Create Challan Correction Request" on the webpage

- Choose the correction type:

- assessment year

- major head

- minor head

- Enter either the Assessment Year or Challan Identification Number (CIN)

- Depending on your choice, view either specific CIN details or a list of challans for the chosen Assessment Year. Choose the relevant challan for correction.

- Input the correct information

- Verify the correction using Aadhaar OTP, Digital Signature Certificate (DSC), or Electronic Verification Code (EVC) through net-banking, Demat, or bank account.

- Once the correction is successfully verified, you will receive a success message along with a transaction ID. Keep the transaction ID for tracking the status of your correction request.

What is Advance Tax Late Payment Interest?

Interest on Advance Tax u/s 234B

As per Section 234B, you must pay at least 90% of the total taxes as advance tax or TDS/TCS by 31st March. Failure to make advance tax payments will result in an interest @1% on the unpaid amount.

Interest on Advance tax Instalments u/s 234C

If the advance tax instalments are not paid within the specified due dates, interest at 1% per month is payable.

| Particulars | Rate of Interest | Period of Interest | Amount on which interest is calculated |

| If Advance Tax paid by 15th June is less than 15% | 1% per month | 3 months | 15% of Amount (-) tax paid before June 15 |

| If Advance Tax paid by 15th September is less than 45% | 1% per month | 3 months | 45% of Amount (-) tax paid before September 15 |

| If Advance Tax paid by 15th December is less than 75% | 1% per month | 3 months | 75% of Amount (-) tax paid before December 15 |

| If Advance Tax paid by 15th March is less than 100% | 1% per month | 1 month | 100% of Amount (-) tax paid before March 15 |

Adjustment of Excess/Shortage Advance Tax Amount

Advance tax is the payment of tax during the financial year in 4 instalments based on the estimated income for the year to avoid lump sum tax payment at the year end. If there is a shortage/excess of tax payment after adjusting advance tax, tax deducted at source & tax collected at source, the assessee would arrive at the tax payable or tax refundable, respectively.

Conclusion

It is important to pay advance tax as and when applicable by the taxpayers. Failure to discharge advance tax liability will attract interest under sections 234C and 234B @ 1% per month each. However, in case of an excess payment of advance tax, the taxpayer will be eligible for a refund.

Also Read - Income Tax Slab and Rates for FY 2025-26