Senior Citizen Savings Scheme (SCSS) 2026: Interest Rate, Tax Benefits & Limit

Senior Citizen Savings Scheme is a government backed retirement plan for individuals aged above 60 years. Eligible individuals can invest a minimum of Rs. 1000 up to Rs. 30 lakh for a period of 5 years with SCSS interest rate of 8.2% per annum. The principal amount invested can be claimed as a deduction under section 80C of the Income Tax Act up to Rs. 1.5 lakhs.

Senior Citizen Savings Scheme (SCSS) Details

Feature Details Tenure 5 Years (Extendable for additional 3 years) Eligibility Individuals aged above 60 years Minimum Investment Rs. 1,000 Maximum Investment Rs. 30 Lakh (in multiples of Rs. 1000) Interest Rate 8.2% p.a. Tax Benefit Deduction up to Rs. 1.5 lakh under Section 80C

Senior Citizen Savings Scheme Interest Rate

The senior citizen savings scheme interest rate is 8.2% for FY 2025-26. SCSS interest rate is changed every quarter and the interest payment is also quarterly on the first day of each quarter.

Senior Citizen Savings Scheme Tax Benefits

- The principal amount deposited in the SCSS scheme can be claimed as deduction under section 80C of the Income Tax Act.

- If the total interest in SCSS accounts exceeds Rs 1 lakh p.a., TDS will be deducted.

- If the account is opened by individuals less than 60 years, TDS will be deducted if the total interest exceeds Rs 50,000 per annum.

SCSS Calculator 2026

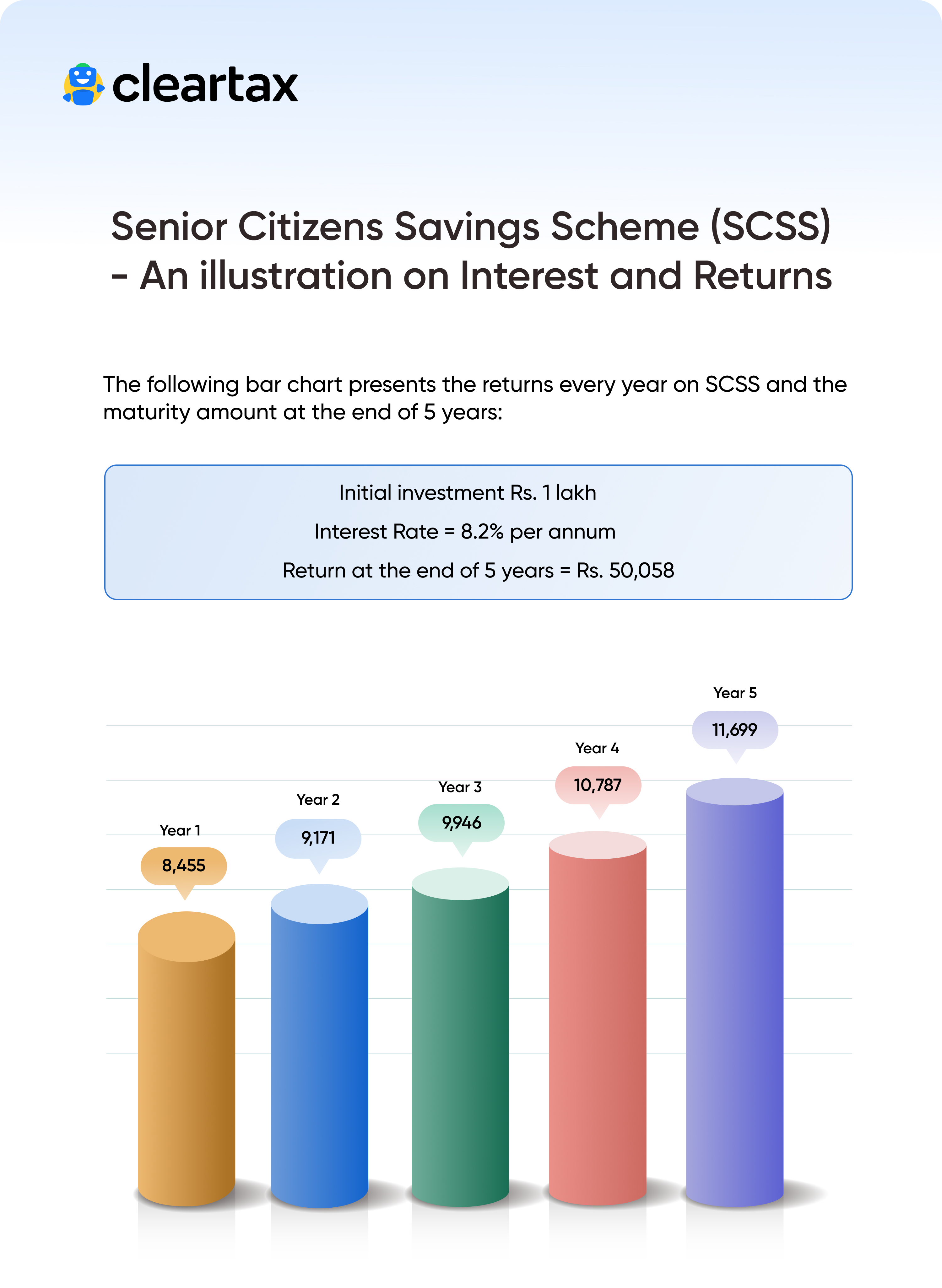

The following illustrations explains the returns on a Rs. 1 lakh investment for a period of 5 years in SCSS. The SCSS interest rate is 8.2% for FY 2025-26.

Senior Citizen Savings Scheme Eligibility

The following individuals can open a SCSS account with a post office or bank:

- Individuals above 60 years.

- Retired civilian employees aged 55 to 60 years can open SCSS account within 1 month of receipt of retirement benefits.

- Retired defense employees aged 50 to 60 years can open SCSS account within 1 month of receipt of retirement benefits.

- Account can be opened in an individual capacity or jointly with spouse only.

However, Non-Resident individuals and Hindu Undivided Families (HUFs) are not eligible for SCSS. It is also mandatory to have PAN and Aadhar to open a SCSS account.

Features of SCSS

The following are the features of the Senior Citizen Savings Scheme.

1. Secure Investment

- Since SCSS is a government-backed scheme, there is a guarantee of returns upon its maturity.

Although cash deposits are allowed up to Rs. 1 lakh, bank payments are mandatory for deposits exceeding the limit.

2. Multiple and Joint Accounts

- Individuals can open more than one SCSS account.

- However, joint accounts can be opened with the spouse only, and the whole deposit is attributed to the first account holder.

3. Nominations

- Nominees can be appointed either while opening an SCSS account or after.

4. Deposit

- Although cash deposits are allowed up to Rs. 1 lakh, bank payments are mandatory for deposits exceeding the limit.

- The minimum deposit is Rs 1,000 and the maximum is Rs 30 lakh, which can be made in multiples of Rs 1,000.

- The deposit amount is restricted to the retirement benefits received. It should be deposited in one installment within one month from the receipt of retirement benefits.

- Retirement benefits here includes provident fund dues, gratuity, commuted value of pension, leave encashment, savings element of Group Savings Linked Insurance Scheme, retirement-cum-withdrawal benefit under the Employees’ Family Pension Scheme and ex-gratia payments under a voluntary or a special voluntary retirement scheme.

- If the deposit is in excess of the ceiling amount, the excess amount shall be refunded to the account holder immediately.

5. Transfer of an Account

- An SCSS account can be transferred between a post office and a bank. Also, it is transferable across India.

6. Premature Closure and Withdrawal

- Individuals can withdraw the amount and close the account at any time on an application in Form 2.

- Premature withdrawal can be made only once. Withdrawals from SCSS accounts will be exempt from tax starting August 29, 2024.

- Penalty on premature withdrawal are as follows:

| Period of Closure | Penalty amount |

| Before one year | Interest paid in the account shall be recovered from the principal amount. |

| Between one to two years | 1.5% of the principal amount shall be levied as a penalty |

| After 2 years | 1% of the principal amount will be levied as a penalty. |

7. Maturity

- The maturity period of SCSS is 5 years, further extendable up to 3 years.

- The application for extension should be within one year of the date of maturity.

Which Banks Offer SCSS?

The authorised banks that offer Senior Citizen Savings Scheme are as follows:

| List of Banks offering Senior Citizen Savings Scheme | ||

| ICICI Bank | Canara Bank | Oriental bank of Commerce |

| Andhra bank | Central Bank of India | Punjab National Bank |

| Bank of Maharashtra | Dena Bank | State bank of Bikaner & Jaipur |

| Bank of Baroda | IDBI Bank | State Bank of Hyderabad |

| Bank of India | Indian Bank | State Bank of India |

| Corporation Bank | Indian Overseas Bank | State Bank of Mysore |

| State Bank of Patiala | State Bank of Travancore | Syndicate Bank |

| UCO Bank | Union Bank of India | United Bank of India |

Along with these banks, the Post Office also offers SCSS.

How to Open SCSS Account?

You can download the SCSS application form for account opening from the India Post website. You can collect the SCSS application form either at the post office branch or on the official website of the India Post. The following documents are required to open SCSS account:

- Two passport-size photographs

- Identity proof, such as a PAN card, Voter ID, Aadhaar card or passport.

- Proof of address, such as Aadhaar card or telephone bills.

- Proof of age, such as PAN card, Voter ID, birth certificate or senior citizen card.

Moreover all the documents must be self-attested by the applier.