Budget 2026 Highlights: Key Takeaways, PDF Download, Important Points

Switch Language

The Union Budget 2026 was presented on 01st February, 2026 by the honourable finance minister Smt. Nirmala Sitharaman. This budget marks the ninth consecutive budget of the finance minister.

Primary emphasis was made on economic stability and sustainability, infrastructure development, manufacture and MSMEs, railways, ease of living, ease of compliance and emerging sectors like artificial intelligence, semiconductor manufacture, etc.

Budget 2026 Highlights at a Glance

- Budget allocation for public infrastructure increased to ₹12.2 lakh crore for FY 2026–27.

- Emphasis on long term growth

- Defence budgte allocation increased to Rs. 7.85 lakh crores, due to increased global tensions.

- A Person Resident Outside India can now invest in Indian listed equities through the Portfolio Investment Scheme, with an increased limit of 10%.

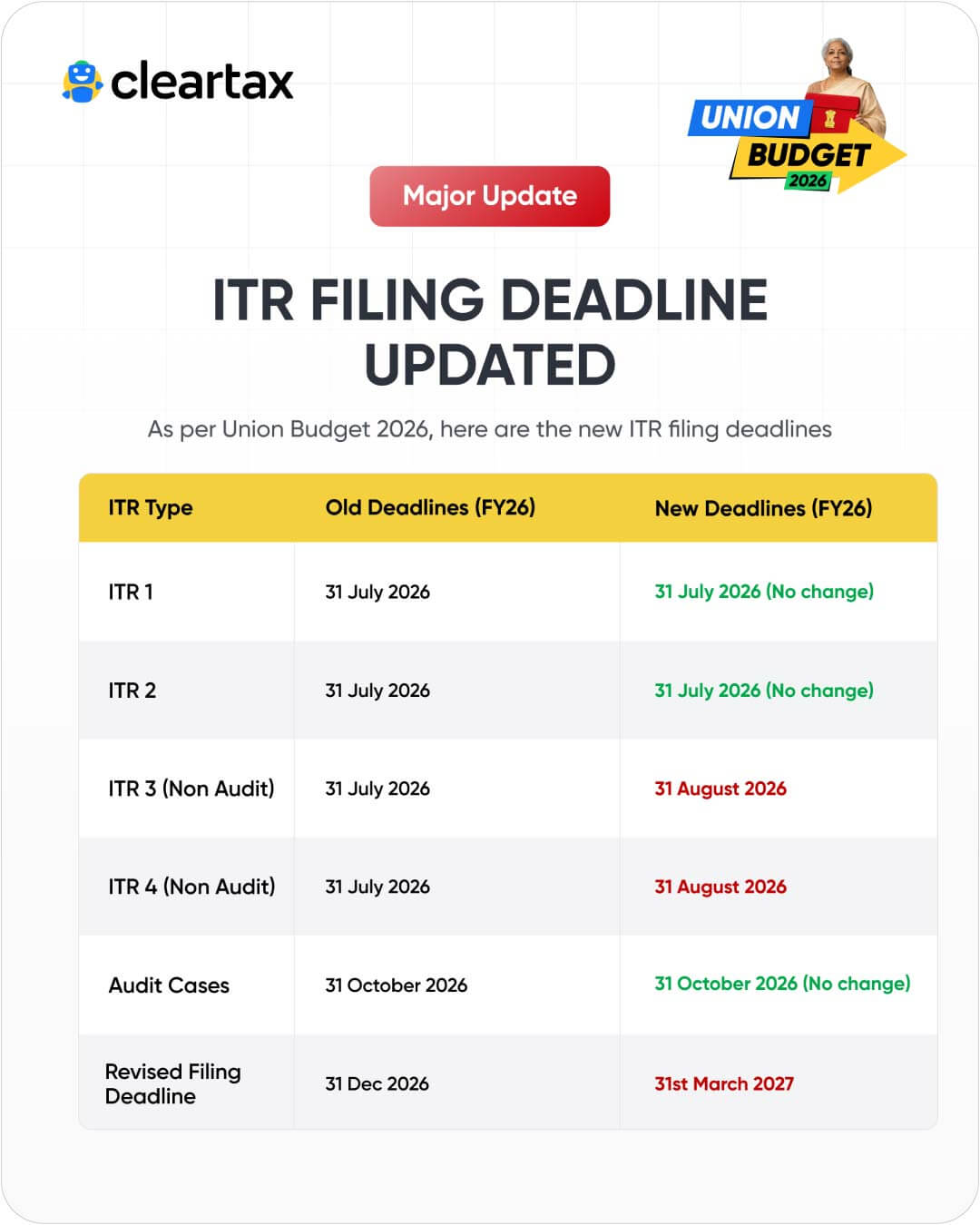

- Due date for filing revised return has been extended to 31st March of the subsequent tax year, with a nominal fee.

- Due date for filing ITR for non-tax audit cases for business taxpayers has been extended to 31st August of the subsequent tax year.

- Sovereign Gold Bonds (SGBs) can now be excluded from capital gain taxation only if they were originally subscribed and held continuously till maturity.

- Interest expense deduction against dividend income and units of mutual funds are removed from the upcoming tax year.

1. Three Kartavyas - Main Duties to Citizens

The Union Budget 2026 focusses on three kartavyas, (refers to responsibility or moral obligation of the Indian Governement to the citizens of India

- Accelerating and sustaining economic growth

- Fulfilling citizens' aspirations

- Ensuring inclusive development (Sabka Saath, Sabka Vikas)

2. Infrastructure & Connectivity

- Public capital expenditure is proposed to increase to ₹12.2 lakh crore in FY 2026–27.

- Expansion of freight corridors and national waterways is proposed to reduce logistics costs and improve market integration.

- City Economic Regions are proposed to strengthen city-led growth and regional development.

- Seven high speed rail corridors are proposed to be established, connecting major cities like Hyderbad, Bangalore, Chennai, Delhi, etc.

3. MSMEs & Enterprises

- A ₹10,000 crore SME Growth Fund is proposed to support high-potential MSMEs and create “Champion SMEs”.

- The Self-Reliant India Fund (set up in 2021) is proposed to be topped up by ₹2,000 crore to continue supporting micro enterprises with risk capital.

- TReDS reforms are proposed to improve MSME liquidity, including mandatory usage by CPSEs and credit guarantee support for invoice discounting.

Direct Tax Proposals

Key Income Tax changes in Budget 2026

- Extension of due date to file revised return to 31st March, with a nominal fee up to Rs 5,000.

- Extension of due date to non-audit business taxpayers to 31st August, from 31st July.

- Sale of shares on buyback will be taxed under capital gains.

- Tax exclusion for Sovereign Gold Bonds redemption is now available only if the bonds are originally subscribed.

- TCS rate changes for specified goods, overseas education and medical remittances and overseas tour package program.

i. Extension of Due Date for Non-Audit Taxpayers

- For non-audit taxpayers except those who file ITR 1 and ITR 2, the due date for filing ITR is extended to 31st August. This extension is applicable from FY 2025-26 (AY 2026-27).

- Simply put, the due dates for ITR-3 and ITR-4 have been extended to 31st August.

- For the upcoming assessment year, the due date for such taxpayers is 31st August 2026.

ii. Extension of Revised Return Due Date

- The due date for the revised ITR has been extended to 31st March from 31st December.

- However, if you file the revised return after 31st December, the following late fees are applicable:

Income Level | Late Fee |

| Up to Rs. 5 lakh | Rs. 1000 |

| More than Rs. 5 lakh | RS. 5000 |

- These changes are applicable from 01st April 2026.

iii. STT Changes

Contrary to expectations, the Securities Transaction Tax (STT) is proposed to be increased for selected securities. The proposed changes in STT are given in the table below:

Security | Present Rate | Proposed Rate |

| Futures | 0.02% | 0.05% |

| Options premium | 0.10% | 0.15% |

| Options exercise | 0.13% | 0.15% |

iv. Taxation of Sovereign Gold Bonds

- Sovereign Gold Bonds are not taxable if they are redeemed. Every SGB holder is eligible for redemption from 5th year.

- This budget has added an additional condition, that the bonds should be originally subscribed for availing this benefit of tax exclusion.

- SGBs that are purchased during the tenure are not eligible for this tax exclusion.

- Simply speaking, from the upcoming tax year, SGBs are exlcuded from capital gain taxes only if they are originally subscribed and held till redemption.

- However, interest on SGBs are still taxable.

v. Removal of Interest Deduction against Dividend

- 20% deduction available against dividend income and units of mutual funds are removed. From now, on the dividend and income from mutual fund units are fully taxable, under the head income from other sources.

vi. TCS Rate Changes

The following table shows the present and proposed TCS rates.

Specified goods | Present Rate | Proposed rate |

| Alcoholic liquor for human consumption | 1% | 2% |

| Tendu Leaves | 1% | 2% |

| Scrap | 1% | 2% |

| Education and medical remittances above Rs 10 lakhs under LRS | 5% | 2% |

| Remittance for Overseas tour package program | 5% up to Rs 10 lakh, and 20% exceeding Rs 10 Lakhs | 2% for all remittances |

vii. Form 15G and 15H Changes

- Lower Tax Deduction Certificates (Form 15G and 15H) under section 395 of the Income Tax Act 2025 can now be applied for electronically. Previously, certain states have enabled online applications for LTDC.

- Also, persons can submit their lower tax declarations to the depositories directly (e.g., CDSL, NSDL) for lower TDS deduction on interest, dividends, and income from mutual fund units.

- The declaration will be forwarded to all companies and entities that pay the investors.

- Previously, taxpayers were required to submit the certificate to every fund house and other payers. To avoid this cumbersome process amendment has been made to section 393(6) of the Income Tax Act 2025.

- Supply of manpower is subject to TDS for works contracts, not as fees for providing technical services.

viii. Buyback Provisions

- Currently, all the sale proceeds from the sale of shares on buyback is treated as dividend income.

- As per the budget amendments, share sales on buyback is taxed under capital gains.

- For promoters, an additional buyback tax is levied. This will make the effective tax outgo for buyback transactions at 22% for corporate promoters and 30% for non-corporate promoters.

ix. TDS Procedural Changes

- Presently, when an NRI sells immovable property, the buyer must apply for a TAN and deduct TDS under section 194IA for the transaction.

- As per the Budget 2026 changes, the buyer is no longer required to apply for a TAN; they can now obtain a PAN-based challan and fulfil the TDS requirements.

x. Foreign Asset Disclosure Scheme for Small Taxpayers

- All residents owning foreign assets, including movable and immovable property, bank balances, etc., must fulfil the foreign asset disclosure requirements as laid down in the act.

- However, small taxpayers, such as former students with dormant foreign bank accounts and ESOP and RSU holders of foreign companies, failed to comply with the requirements due to inadvertence.

- A scheme has been proposed under the Finance Bill 2026, nudging non-compliant small taxpayers to provide their foreign asset disclosures as per the provisions of the act.

This scheme is divided into two parts, Part-A and B.

- Part A applies to taxpayers who did not make the foreign asset disclosure and income whose limit does not exceed Rs 1 crore rupees.

- For these cases, 30% of the value of assets and income not disclosed, and a 100% of additional tax needs to be paid.

- Part B deals with cases wherein foreign income is disclosed and taxed, while the corresponding foreign assets are not disclosed.

- In such cases, the default quantum should not exceed Rs 5 crore, and a fee of Rs 1 lakh needs to be paid.

xi. Tax Holiday for Non-Residents and Foreign Companies

- Until 2047, all foreign companies that render cloud services using data centres located in India are tax-exempt to the extent of income arising in India.

- A non-resident expert who stays in India for more than 5 consecutive years may be tax-exempt, provided that his or her stay is for a purpose related to a Central Government-notified scheme.

- The Minimum Alternative Tax (MAT) is exempt for all non-residents who pay taxes under the presumptive scheme.

xii. IFSC Exemptions

- For all the Overseas Banking Units (OBUs) situated in Special Economic Zone (SEZ) , the tax holiday is extended to 20 years, from the current limit of 10 years.

- For IFSC units, a tax holiday of 20 years out of 25 consecutive years shall be allowed. This is an extension from the current limit of 10 out of 15 years.

xiii. Other Important Amendments

- Motor Accidents Claims Tribunal: interest on compensation received is exempt; no TDS is required on the same.

- The Income Computation and Disclosure Standard (ICDS) requirements are now to be incorporated in the Indian Accounting Standards (IND AS) itself. The requirement of ICDS will be scrapped with effect from the tax year 2027-28.

4. Banking & Financial Sector

- A High-Level Committee on Banking for Viksit Bharat is proposed to review and align banking sector reforms with India’s next phase of growth.

- NBFC reforms are proposed, including the restructuring of Power Finance Corporation (PFC) and Rural Electrification Corporation (REC) to improve scale and operational efficiency.

- Measures are proposed to deepen the corporate bond and municipal bond markets to support long-term financing.

5. Agriculture & Rural Economy

- New programmes are proposed to promote high-value crops such as coconut, cocoa, cashew, sandalwood, and nuts to improve farmer incomes.

- An AI-enabled agricultural advisory platform (Bharat-VISTAAR) is proposed to support farm decision-making.

6. Other Sectoral Highlights

Tourism, Culture & Sports

Proposals are announced to strengthen tourism infrastructure, develop archaeological and cultural sites, and scale up the sports ecosystem through a long-term mission approach.

Services, Skills & Employment

- A High-Powered ‘Education to Employment and Enterprise’ Standing Committee is proposed to strengthen services-sector jobs, skills, and exports.

- Sector-specific skilling initiatives are proposed across healthcare, tourism, AVGC, and design.

Union Budget 2026 presents sector-wise highlights covering new schemes, policy reforms, and priority areas across the economy.

7.

8. Indirect Taxes Changes

i. GST – Structural Tightening Without Rate Noise

Budget 2026 does not introduce headline GST changes as expected, but it deepens the system-first approach to GST enforcement. Amendments under the Finance Bill strengthen Central Goods and Service Tax (CGST) provisions around valuation, credit adjustments, refunds, and appellate mechanisms-

Post-sales Discount:

- Section 15 has been amended to clarify the treatment of post-sale discounts in the value of taxable supply.

- There is no requirement to link the post-sale discount to an agreement or to refer to the issuance of a credit note when the input tax credit is reversed by the recipient.

Linkage of CDNs with invoices-

- Amendment to Section 34 on Credit Notes and Debit Notes tightens conditions for issuance, reporting, and linking credit notes and debit notes to original invoices, especially when adjustments affect tax liability or input tax credit.

Amendments on Refunds: Section 54 has been amended in two important ways:

- Inverted Duty Structure refunds are now eligible for provisional refunds, improving cash flow while the final refund is processed.

- The minimum refund threshold for exports made on payment of GST has been removed, allowing exporters to claim refunds without being constrained by a monetary floor.

Advance Rulings & Related Conflicts:

- Amendments made in section 10A strengthen the role of Nthe ational Appellate Authority for Advance Ruling in resolving conflicting advance rulings.

- Primary focus is on such advance rulings issued by State Authorities in cases involving the same applicant or identical questions.

- The amendment refines Section 101A to strengthen the role of the issued by

- This amendment reinforces NAAAR as the final authority for ensuring uniformity in GST interpretation.

Amendment of section 13 of the IGST Act:

- The special rule for intermediary services is being removed.

- So, the place of supply will be determined by the general rule (the recipient's location), which may reduce disputes and improve export clarity.

The changes are applicable from 1st April 2026, subject to notification by the CBIC.

ii. Customs – Strategic Enforcement Aligned to Manufacturing Policy

On the Indian Customs side, Budget 2026 reinforces India’s manufacturing and supply-chain localisation agenda. While tariff rationalisation continues to support domestic production, enforcement around classification, valuation, and exemptions is expected to tighten.

Simplification of Tariff Structure

- The tariff structure is proposed to be simplified to reduce complexity, correct duty inversion, and improve export competitiveness while supporting domestic manufacturing.

Removal of Customs Duty Exemptions

- Certain exemptions are proposed to be withdrawn for goods now manufactured domestically or where import volumes are insignificant, to rationalise the exemption framework.

Incorporation of Effective Rates in the Tariff

- Effective customs duty rates are proposed to be built directly into the tariff schedule, reducing dependence on separate exemption notifications.

Seafood Export Inputs

- The duty-free import limit for specified seafood processing inputs is proposed to be increased from 1% to 3% of the previous year’s FOB export turnover.

Fish caught by Indian Vessels

- In the Exclusive Economic Zone (EEZ) or on the high seas are made duty-free, with landing at foreign ports treated as an export of goods.

Leather, Textile, and Garment Exports – Time Extension

- The export time limit for final products is proposed to be extended from six months to one year for leather, textile garments, footwear, and related products.

Expansion of duty-free Imports for Leather and Footwear

- Duty-free import benefits for specified inputs are proposed to be extended to additional export categories in the leather and synthetic footwear sectors.

Battery Energy Storage Systems (BESS)

- The basic customs duty exemption on capital goods for lithium-ion cell manufacturing is proposed to be extended to BESS as well.

Solar Manufacturing Inputs

- Basic customs duty is proposed to be exempted on sodium antimonate, a key input used in the manufacture of solar glass.

Nuclear Power Projects

- The existing customs duty exemption for nuclear power project imports is proposed to be extended till 2035 and made applicable to all nuclear plants, irrespective of capacity.

Critical Minerals Processing

- A customs duty exemption is proposed on capital goods imported for processing critical minerals within India, supporting domestic value addition.

Biogas blended CNG

- The entire value of biogas is proposed to be excluded from the computation of the central excise duty on biogas-blended CNG.

Civilian Aircraft Manufacturing

- Basic customs duty is proposed to be exempted on components and parts required for manufacturing civilian training and other aircraft.

Defence MRO (Maintenance, Repair, and Overhaul)

- A customs duty exemption is proposed for raw materials imported for the manufacture of aircraft parts used in defence MRO operations.

Microwave Oven Manufacturing

- Basic customs duty is proposed to be exempted on specified parts used in the manufacturing of microwave ovens to deepen domestic value addition.

Validity of advance rulings under Customs extended from three years to five years, improving certainty for importers and exporters.

The changes are applicable from 1st April 2026, subject to notification by the CBIC.

Budget 2026 PDF Download

- Download the Union Budget 2026 speech

- Download the Union Budget 2026 Highlights

Conclusion

The budget 2026 primarily focused on economic security, self reliance, and indigenous development, with focus on simplification and better compliance.

Don't miss the highlights from previous years' Budgets!

Budget 2025 Highlights

Budget 2024 Highlights

Budget 2023 Highlights

Related Article:

1. Budget 2026 Live Updates

2. Economic Survey 2026

3. Union Budget 2026: Sector-Wise Impact on the Stock Market & Mutual Funds

Frequently Asked Questions

About the Author

I’m a Chartered Accountant with a deep interest in Direct Tax Laws, drawn to the fascinating blend of numbers and legal provisions. Right from my preparation days, I had specific attraction on areas where tax provisions are often difficult to interpret, aiming to simplify and make them easily understandable.I stay updated by connecting with other professionals and closely following industry news and media.My approach to writing is straightforward and comprehensive, ensuring that even complex topics are accessible to a wide audience.. Read more