Hindu Undivided Family – HUF Meaning, Benefits & How to Reduce Tax?

A Hindu Undivided Family (HUF) is a powerful and legal tax-saving tool under Indian income tax law, used for income splitting and wealth management. As a separate taxable entity, it can earn income and claim deductions like Section 80C, 80D, and capital gains exemptions.

Key Highlights

- HUF is a separate person from the family members for tax purposes.

- Income of members can be split and shown as HUF income legally, allowing more tax benefits.

- HUF enjoys a separate basic exemption limit of Rs. 2.5 lakh under the old tax regime and Rs. 4 lakh under the new tax regime.

What is an HUF?

- The full form of HUF is Hindu Undivided Family.

- It is a separate legal entity under the Income Tax Act, created for tax purposes.

- This is one of the tax saving strategies legally available to joint families.

- An HUF can own property, earn income, and claim tax benefits independent of its members, helping families reduce their overall tax liability by legally splitting income.

- The head of the HUF is called the Karta, while the family members are coparceners.

Who can Form HUF?

- Buddhist, Sikh and Jain families are also covered under the ambit of HUF.

- HUF cannot be created by one person. Minimum of 2 persons are required to form an HUF.

- A family with lineal ascendants and descendants is required to form an HUF.

- An HUF can be created upon marriage as well.

Who are the Members of HUF?

The members of an HUF are common ancestor and all lineal descendants, including their wives and unmarried daughters. The members include:

- Karta: The head of the HUF, usually the senior-most male or female member, who manages the family affairs and has unlimited liability.

- Coparceners: All male and female lineal descendants of a common ancestor, including daughters by birth, who have equal rights in HUF property and can demand partition.

- Other Members: Wives of coparceners become members of HUF after marriage but are not coparceners themselves. They have maintenance rights but no right to demand partition.

Only coparceners can claim partition of HUF, while Karta carries unlimited liability for HUF dues, including tax obligations.

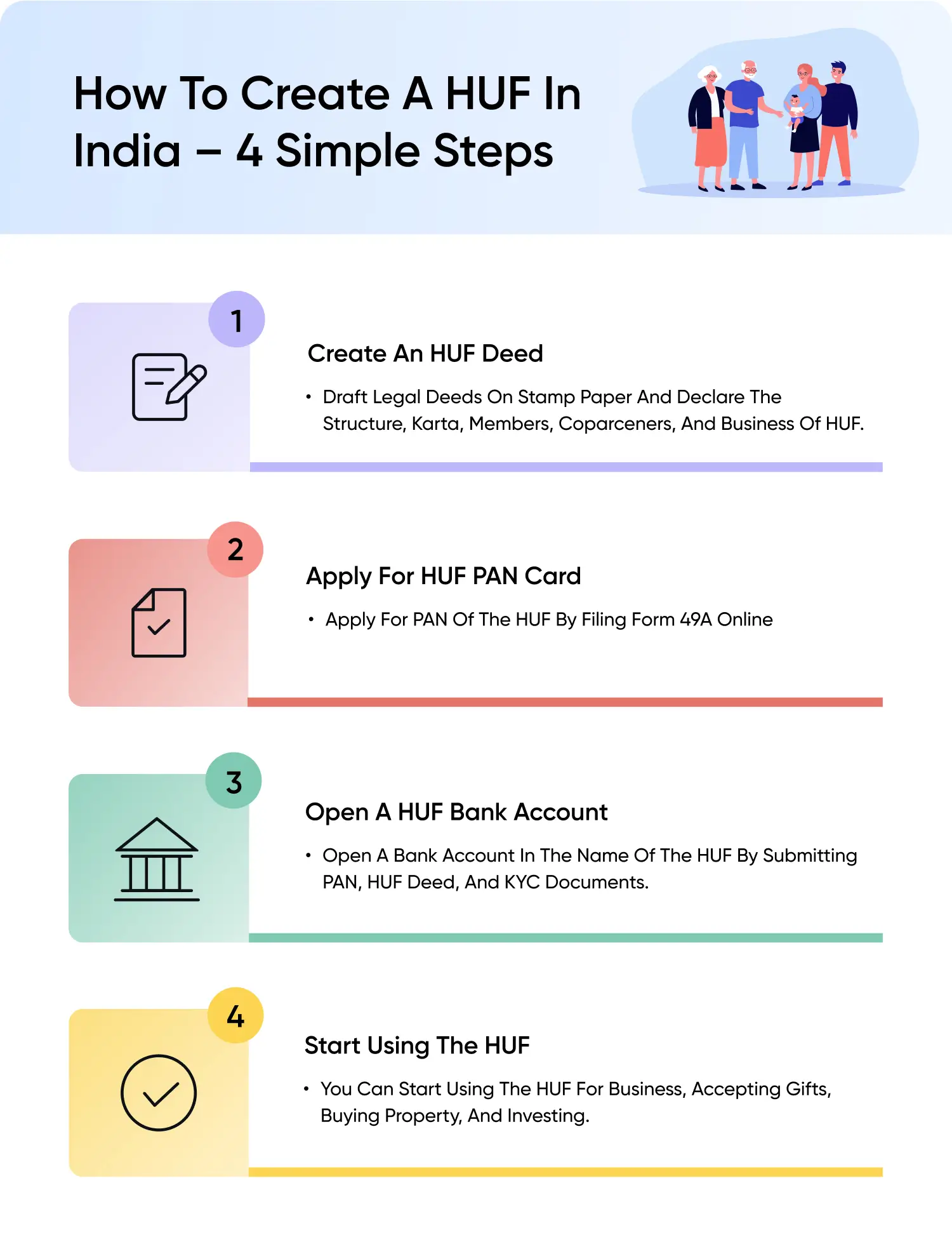

How to Form an HUF - A Step-by-Step Guide

Forming an Hindu Undivided Family (HUF) is simple and involves steps like creating an HUF deed, applying for an HUF PAN card, opening a bank account, and starting the operations of the HUF.

Step-1: Create an HUF Deed

- The first step to form an HUF is to draft a HUF deed.

- It should contain the name of the Karta, coparceners, their personal details, date of formation, amount and sources of HUF corpus, and other required details as the situation demands.

Step-2: Obtain a PAN Card

- PAN application for HUF can now be made online.

- Karta needs to make an application in form 49A along with other necessary declarations.

- Usually, digital PAN, or PAN number is generated within 48 hours of application.

Step-3: Open an HUF Bank Account

- With the PAN obtained, you can now apply for bank account in the name of HUF, in order to undertake all the transactions under the name of HUF.

- You have to submit HUF deed, PAN and other KYC documents to open a bank account in HUF.

Step-4: Transfer the Common Assets to HUF

- All the assets intended to be used under the name of HUF, including properties, liquid cash, deposits etc. can be transferred to the common pool of HUF.

Tax Implications of HUF

HUF Residential Status

The residential status of an Hindu Undivided Family (HUF) depends on whether it is controlled from India or not.

Resident HUF

An HUF is Resident in India if its controlled and managed from India during the previous year. Partial control ia also considered as control from India.

If the Karta of an Hindu Undivided Family (HUF) is resident and ordinarily resident in India, then the HUF is also treated as resident and ordinarily resident. However, if the Karta is resident but not ordinarily resident, then the HUF is considered resident but not ordinarily resident.

Non - Resident HUF

An HUF is Non-Resident if its control and management are wholly situated outside India during the previous year.

The Bottom Line: The residential status of HUF depends on the residential status of Karta, when it is controlled or managed from India. Otherwise, the HUF is always considered a Non-Resident.

HUF Tax Slabs

HUF income taxes are quite similar to that of individual taxation, except a few differences. The HUF tax slabs are the same as individual taxpayers under both the Old Regime and New Regime. The tax slabs are same for HUF irrespective of whether the HUF is a resident or not, under both the regimes.

New Tax Regime Slabs

FY 2025-26

Under the new regime, the tax slabs of HUF for the financial year 2025-26 are as follows:

| Income Tax Slabs | Income Tax Rates |

| Up to Rs. 4 lakhs | Nil |

| Rs. 4 lakhs to Rs. 8 lakhs | 5% |

| Rs. 8 lakhs to Rs. 12 lakhs | 10% |

| Rs. 12 lakhs to Rs. 16 lakhs | 15% |

| Rs. 16 lakhs to Rs. 20 lakhs | 20% |

| Rs. 20 lakhs to Rs. 24 lakhs | 25% |

| Above Rs. 24 lakhs | 30% |

Old Tax Regime Slabs

Under the old tax regime, the slab rates of the HUF are as follows.

| Income Tax Slabs | Income Tax Rates |

| Up to Rs. 2.5 lakh | Nil |

| Rs. 2.5 lakh - Rs. 5 lakh | 5% |

| Rs. 5 lakh - Rs. 10 lakh | 20% |

| Above Rs. 10 lakh | 30% |

Note:

- Relaxed slab rates applicable for resident senior and super senior citizens are not applicable for HUF.

- Surcharge and cess will be applicable.

Rebate

It is popularly believed that rebate can be claimed if the taxable income of HUF is below RS. 7 lakhs under the new regime and Rs. 5 lakhs under the old regime (Rs. 12 lakhs under the new regime for FY 2025-26). But it is not true. Rebate is not available for HUFs. It can only be claimed by individuals who are resident. However, there are various tax benefits avilable to HUFs, as follows:

HUF Tax Benefits

HUFs enjoy the same income tax slabs as individuals, with a basic exemption of Rs. 2.5 lakh (old regime) and Rs. 4 lakh (new regime for FY 2025-26). As we already know, the HUF is treated as a separate person for tax purposes. Therefore, income tax slabs, deductions limit are separate for HUFs, apart from the members of HUF. Hence, a part of income can be split from the members and shown as HUF income as appropriate, reducing overall tax liability.

Key tax benefits for HUF include:

- Section 80C: Up to ₹1.5 lakh deduction on PPF, ELSS, life insurance, etc.

- Section 80D: Deduction for health insurance premiums paid for HUF members.

- Section 80G: Deductions on eligible donations made by HUF.

- Home Loan: Deduction on interest paid on housing loan.

- Capital Gains: Exemptions under Sections 54, 54F, and 54EC on reinvestment of long-term capital gains.

How to Save Taxes by Forming HUF?

Let’s understand how an HUF is taxed with an example –

Mr Rajesh Chopra decides to start an HUF with his wife, son, and daughter as members. The property held by Mr. Chopra earns an annual rent of Rs. 15 lakh which was transferred to the HUF. Mr. Rajesh Chopran Has an income from salary of Rs. 20 lakh.

By creating an HUF, Mr. Chopra can save tax under the New Tax Regime for FY 2025-26 as follows:

| Income from Various Sources | Individual's Return | HUF's Return | |

| Income of Mr. Chopra before formation of HUF | Income of Mr. Chopra after formation of HUF | Income of HUF | |

| A) Salary | 20 lakhs | 20 lakhs | |

| B) House property rent | 15 lakhs | – | 15 lakhs |

| C) Standard deduction on house property (30% of 15 lakhs) | (4,50,000) | – | (4,50,000) |

| D) Income from house property (B-C) | 10,50,000 | – | 10,50,000 |

| Total Taxable Income (A+D) | 30,50,000 | 20 lakhs | 10,50,000 |

| (-) Standard Deduction | (75,000) | (75,000) | - |

| Net Taxable Income | 29,75,000 | 19,25,000 | 10,50,000 |

| Tax Payable | 4,91,400 | 1,92,400 | 46,800 |

Summary comparison of taxes, with and without splitting the income to HUF:

| Comparison | |

| Total tax paid by Mr. Chopra | 4,91,400 |

| Total tax paid by Mr. Chopra & HUF | 2,39,200 |

| Tax saving due to forming an HUF | 2,52,200 |

Due to this tax arrangement, Mr. Chopra saved Rs. 2,52,200 in taxes. The HUF paid Rs. 46,800 tax on the rental income, as the rebate u/s 87A is not available for HUF.

One person cannot form HUF, it can only be formed by a family. It includes the husband, wife and their children.

Risks and Challenges of an HUF

Though HUF is a good tax saving strategy, the following are the disadvantages of forming an HUF:

- Partition disputes

- Complex compliance

- Limited applicability

- HUF cannot receive salary

Dissolution of an HUF

an Hindu Undivided Family (HUF) can be dissolved through partition, where the assets are distributed among the coparceners (family members with inheritance rights). This partition may be:

- Total Partition: All assets of the HUF are divided, and the HUF ceases to exist.

- Partial Partition: Only some assets are divided, and the HUF continues for the remaining assets.

For the partition to be legally valid, a partition deed must be drafted, stamped, and registered. The HUF’s PAN card is surrendered to the tax authorities to complete the dissolution process.

Frequently Asked Questions